- Over the past few years, several states in India have attempted to renegotiate contracts, for a better price, with solar power developers.

- This trend started with Andhra Pradesh in 2019 and was then followed by Gujarat and Rajasthan. Now, recently, Uttar Pradesh cancelled the secured bids for a solar contract.

- Solar industry and other experts say that if states fail to abide by the commitments made to investors and developers, they may jeopardise India’s long-term goal of largescale adoption of clean energy.

- Flip-flip on policy and regulatory issues, like the cancellation of Power Purchase Agreements (PPAs), could dissuade investors and endanger foreign investment that India requires for growth in the clean energy sector.

The Indian government has been attempting to boost the solar sector in its pursuit of ambitious renewable energy targets. However, the sunshine sector could be eclipsed by the flip-flop on policy by state governments which, over the last two years, have been renegotiating contracts with power developers to achieve a lower price per unit of electricity.

In 2015, India had set a target of installing 175 gigawatts (GW) of renewable capacity by 2022. With a year left for meeting the target, only about 95 GW, a little over half the target, has been met. In fact, according to those following the sector closely, India may not be able to achieve the target by 2022.

The increasing trend of state governments trying to cancel or renegotiate the contracts including the Power Purchase Agreements (PPAs) that were finalised after a proper bidding process adds to the woes of the solar sector. Industry experts observe that this trend has the potential to derail India’s long-term journey towards the green economy as it could erode the confidence of investors.

For instance, last month, Uttar Pradesh cancelled the solar auction process for installing 500 MW solar power, hoping to get a lower price through a new auction process. The auction for 500 MW of solar power in Uttar Pradesh was held in February 2020 where four companies, including Saudi Arabia’s Al Jomiah, won the auction quoting a price of Rs. 3.17-Rs. 3.18 per unit. Later, in November 2020, in another auction, a price of Rs. 1.99 per unit was realised.

At present, Uttar Pradesh has an installed capacity of 3,878 megawatts (MW) of renewable energy while the target set for the state, by the Union Ministry of New and Renewable Energy, was 14,221 MW by 2022, including 10,697 MW of solar power. The cancellation is expected to further slow down Uttar Pradesh’s progress.

Other states such as Andhra Pradesh, Rajasthan, and Gujarat have taken similar kind of steps with private developers. This trend of states trying to renegotiate the lower price for contracts already signed or commitments already made, is a dangerous journey downhill that can destabilise the sector.

Subrahmanyam Pulipaka, chief executive officer of the National Solar Energy Federation of India (NSEFI), which is India’s umbrella organisation of all solar energy stakeholders of India, said that the trend started when the Gujarat government tried to renegotiate the PPA but the court overturned that decision.

Then it started with the Andhra Pradesh government trying to renegotiate the deal, followed by Punjab requesting a discount on tariff, Gujarat cancelling Letter of Intent (LoIs) and now Uttar Pradesh which cancelled a tender after the reverse auction, without issuing the LoIs for more than a year. This trend of renegotiation of contracts has spread like a pandemic and industry’s interests have been constantly overlooked. The industry has already escalated it to most avenues possible in the government system, Pulipaka told Mongabay-India.

While Director Energy Finance Studies, Australia/South Asia at Institute of Energy Economics and Financial Analysis (IEEFA), Tim Buckley emphasised that if the states are cancelling the PPAs purely because the prices of solar dropped, then that is an abuse of the legal position. He said it really undermines the whole balance of power. “When you’re actually doing tenders … you’ve got to treat investors fairly and equitably. And if (they play) heads you win, tails they lose, investors aren’t going to play that game,” he said.

Read More: India looks likely to miss the 2022 renewable energy targets

As solar gets cheaper and uncertainty looms large

In November 2020, the Gujarat Urja Vikas Nigam Limited (GUVNL) during a 500 MW solar auction achieved the tariff of Rs 1.99, which is the lowest bid in India so far.

Experts credit it to India’s reverse auction process and also technology getting cheaper. As a result, India has been recording an 18 percent year-on-year decline and experts believe that in all probability, the price per unit of electricity from solar will further go down. Former CEO of Hero Future Energies Sunil Jain had predicted that the price will touch Rs. 1 per unit before 2030.

Though India’s reverse auction has been appreciated globally and is able to bring better results in terms of price realisation, the subsequent action by authorities seems to be increasing the uncertainty for the developers.

Vibhuti Garg, an energy economist with IEEFA, told Mongabay-India that it is “really worrisome the way things are changing in the sector adding risk and uncertainty which will impact future renewable energy deployment.”

“The per-unit price for solar power has gone down and they are expected to further decline with better technology and finance options in future. But that does not mean that states can keep cancelling the PPAs – especially when they are on an actual cost basis at that point of time,” Garg explained.

The trend creates confusion and uncertainty among the power developers as they are not sure whether their plan to generate power and get their investment back will materialise or not.

Rishabh Jain, who works with the Centre for Energy Finance (CEF) of the Council on Energy, Environment and Water (CEEW), a not-for-profit research organisation, underlines this fact. He said that “at the end of the previous fiscal year (2020-21), nearly 26 GW of projects were under various stages of bidding” and “project developers are second-guessing if their bids will actually see the light of the day.”

He explained to Mongabay-India that “cancellation can happen in the following four phases – before RA (reverse auction), after RA and before LOI issued, between issuance of LOI and the PPA and after the PPA.”

“The impact on the developer increases exponentially after every step. Despite renegotiation of PPA of operational plants, Andhra Pradesh received bids for 14.9 GW for the 6.4 GW tender in February 2021. This is surprising and ironic because the developer and investor community had raised concerns about future investments in the state. Instances like these may encourage off-takers to keep the option of renegotiation/cancellation open in the future,” Jain said.

The government is aware of the issue but despite desperate pleas by the industry, there has not been any concrete solution so far even as the trend is picking up. In March 2020, a parliamentary panel had observed that the issue of “long term Power Purchase Agreement (PPA) has become a conundrum.”

“Since the advent of solar power, its tariff is on a constant decline. In recent years, solar power tariff has aggressively been quoted making the Discoms (power distribution companies) reluctant to enter any long term PPA. This situation is causing disruption as long-term PPA is a pre-requisite for financing any new power project. In absence of long term PPAs it may be difficult to attract investment in the power sector,” it had said.

Read more: [Charts] A long road to 2030 for India’s import-heavy solar power sector

Policy paralysis could impact foreign investment in India’s renewable sector

India’s renewable energy sector has been in a bright spot when it comes to attracting foreign investment. The sector in India has received more than $42 billion in investments since 2014, according to a report compiled by the IEEFA. Tim Buckley, who authored the report, told Mongabay-India that India will require another $500 billion to achieve 450 gigawatts (GW) of installed renewable energy capacity by 2030.

Similarly, the International Energy Agency’s (IEA) Energy Outlook 2021 estimated that about $1.4 trillion will be required for funding for low emission technologies to travel through the sustainable path over the next 20 years.

However, India’s energy demand has been slowing down for the past two years and there are early signs which if not taken seriously can seriously impact the sector. The industry observers believe that the momentum built in the sector around five years seems to be evaporating now. Too many changes and a lot of backtracking has been seen in the past couple of years has the industry worried.

Experts emphasise the government of India has to be careful about its policy statements if they have no intention of delivering because it ultimately is going to undermine its credibility. Besides, not following the terms and conditions of the PPAs, such flip-flops could only add fuel to the fire.

Subrahmanyam Pulipaka from NSEFI says, “India has had a very good renewable policy so far and has attracted national and international investors but somewhere down the line, this trend of renegotiating the contracts started.”

There are already signs of investors worrying about the uncertainty in India’s regulatory system. In May 2021, SoftBank, a Japanese multinational conglomerate and also a major investor in India’s renewable sector, pulled out. It sold SB Energy India to India’s Adani group which has been rapidly expanding its green energy portfolio. The deal worth $3.5 billion was signed in May 2021. Before Adani Green Energy came into the picture, Canada Pension Plan Investment Board (CPPIB) was negotiating with SoftBank Group Corp to buy its 80 percent stake in SB Energy but it had dropped the plan after months of negotiations with SoftBank.

When asked how to read these developments, Buckley from IEEFA said he would be wary of drawing too many generalities from one transaction. SoftBank had hit an extreme financial hurdle back in its home market back then.

“It did certainly put India on the radar globally five years ago. The scale of aspiration from SoftBank for India was enormous. A lot of investors had followed SoftBank and invested in India for better returns. This is important. Among the few problems that SoftBank faced in India included land acquisition and grid access problems,” he said underlining systematic challenges for investors.

It was underlined in the same deal. “We then saw the biggest pension fund in Canada, Canada Pension Plan Investment Board (CPPIB), offering to buy SoftBank’s renewable investment in India. They clearly did due diligence and then pulled out. It is because once they got into the port of SoftBank, they realised there were major contract problems and other challenges like land acquisition, and problem of grid access etc,” Buckley said.

He noted that it’s good that Adani Green Energy stepped up and bought the business but it doesn’t give encouraging signs to global investors. The Canadian pension plan would have been a massive endorsement of India as a capital destination, similar to SoftBank which had been a major global investor in India, he added.

One of the key aspects to attracting global capital to India is the long-term legally binding PPAs. If the issue is not addressed now, it will become problematic for the Indian renewable energy market. Experts believe that investors will increase the prices to ensure that their returns match the extra risk associated with such projects.

“At the end of the day, the casualty is the industry and we may lose investors, projects and even valuable time while we are running against the targets. All we ask from the industry is clarity and withhold the sanctity of contracts” Pulipaka said.

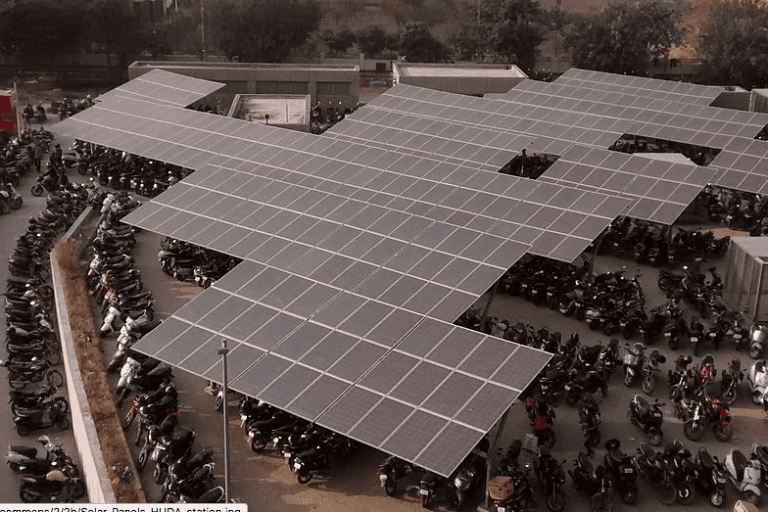

Banner image: Canal Top Solar Power Plant, in Gujarat. Photo by Mark Garten/UN Photo/Flickr